Debts Assistance Insurance Rate (DSCR) financial products are generally special financial products which have been generally utilised by people throughout real estate property along with corporations. These kind of financial products are generally distinctly methodized for you to prioritize your borrower’s cash flow in accordance with his or her active debts What is Dscr Loan requirements. DSCR financial products are generally irresistible to those people hoping to develop his or her portfolios as well as deal with on-going assignments, when they present loans using the applicant’s earnings in lieu of classic cash flow certification.

Being familiar with your debt Assistance Insurance Rate (DSCR)

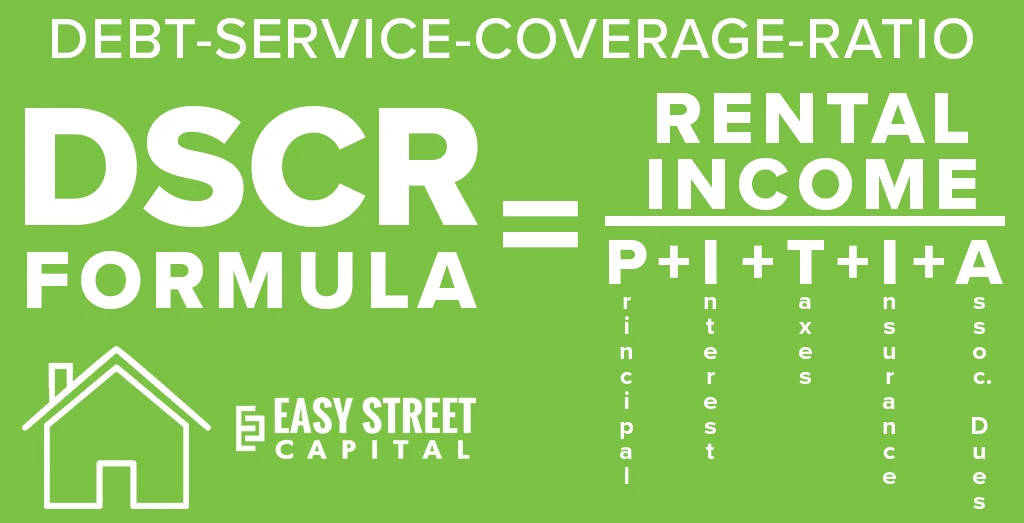

Your debt Assistance Insurance Rate is often a fiscal metric utilised by creditors for you to determine a new borrower’s capacity to settle debts. It can be worked out by simply splitting up your borrower’s world wide web functioning cash flow by simply his or her full debts requirements. The actual result, manifested as being a rate, supplies awareness in the borrower’s fiscal wellbeing. As an illustration, a new DSCR of just one. 30 implies that this consumer features 25% additional money when compared with his or her debts demands, and that is normally a sufficient margin for several creditors.

In the matter of DSCR financial products, creditors count on your rate to get at the least 1. 0, which means that your cash flow made is enough to hide your debt installments. A better DSCR rate normally echos greater fiscal steadiness along with may result in additional beneficial mortgage loan terminology. On the other hand, pertaining to individuals which has a decrease DSCR, the prospect of getting qualification for the mortgage loan could possibly be diminished until the bank welcomes selected mitigations or higher rates.

Precisely how DSCR Financial products Operate

Contrary to classic financial products that require intensive cash flow certification, DSCR financial products target earnings because principal determinant involving eligibility. Creditors determine a new borrower’s DSCR rate by simply inspecting fiscal phrases along with expected cash flow. This specific freedom positive aspects self-employed folks along with real estate property people whom might not exactly get regular regular cash flow nevertheless accomplish make large earnings.

DSCR financial products will often be utilized for real estate investment opportunities, when they let individuals for you to control your procurment cash flow off their components for you to meet the requirements. The amount of money stream via these kind of components allows these people display a satisfactory DSCR, which allows the crooks to financing more purchases. These kind of financial products in addition present cut-throat rates, when they cause a reduced threat pertaining to creditors due to target earnings in lieu of career record as well as personalized cash flow.

Attributes of DSCR Financial products

Freedom throughout Qualifying measures

DSCR financial products offer an substitute for those using non-traditional cash flow solutions, generating these people offered for you to business people along with real estate property people.

A lesser amount of Certification Essential

Considering that these kind of financial products depend upon earnings in lieu of cash flow certification, that they require a lesser number of records demands, streamlining your application for the loan course of action.

Risk of Larger Mortgage loan Portions

Individuals using substantial DSCR rates may possibly be entitled to more substantial mortgage loan portions, allowing them to financing important purchases as well as large-scale assignments.

Entice People

DSCR financial products are generally specially helpful pertaining to residence people, when they will use procurment cash flow for you to meet the requirements along with perhaps develop his or her portfolios.

Challenges Linked to DSCR Financial products

Even though DSCR financial products present extensive positive aspects, these are certainly not with no challenges. Individuals using fluctuating cash flow quantities should find the idea demanding to take care of your DSCR rate through fiscal downturns. Moreover, since these kind of financial products target earnings, there is force in individuals to take care of continuous procurment as well as organization cash flow. A new non permanent fall throughout cash flow can impact your DSCR rate, perhaps bringing about complications throughout mortgage loan monthly payments.

Whom Should look into a new DSCR Mortgage loan?

DSCR financial products are generally perfect pertaining to real estate property people, self-employed folks, along with businesses. This specific mortgage loan variety is wonderful for people that make large earnings via purchases nevertheless might not exactly get regular career cash flow. Individuals throughout these kind of types generally still find it demanding for you to be entitled to classic financial products on account of fluctuating cash flow water ways, generating DSCR financial products a fascinating selection.

People aiming to develop his or her real estate property holdings as well as financing significant assignments generally depend upon DSCR financial products. These kind of financial products allow them for you to control his or her latest earnings for you to risk-free loans with no intensive cash flow certification. Pertaining to businesses whom prioritize expansion, DSCR financial products give a accommodating option that will aligns using income flow-centric fiscal single profiles.

Finish

To conclude, DSCR financial products can be a important instrument pertaining to individuals whom make regular earnings via purchases as well as corporations. By simply centering on your debt assistance insurance rate, creditors measure the borrower’s capacity to deal with debts by way of cash flow in lieu of regular career certification. Using accommodating qualifying measures conditions along with a lesser number of certification demands, DSCR financial products are generally a beautiful selection pertaining to real estate property people along with self-employed folks.

Even though DSCR financial products present distinctive positive aspects, that they feature challenges, specially throughout fluctuating cash flow examples. For the people using continuous procurment cash flow as well as regular earnings, on the other hand, these kind of financial products give you a functional along with useful loans option.

MOST COMMENTED

Uncategorized

10 Methods to Advance Your web Existence

Uncategorized

Mengenal Bata4D: Situs Slot Online Terpercaya dengan Tingkat Kemenangan Tertinggi

Uncategorized

Transforming Ideas into Stunning Liquor Bottles with Kandacork Glass

Uncategorized

The actual Quiet Battle: Unraveling the actual Complexnesses associated with Debt within Society

Uncategorized

Advanced Technology in Private Security Services by Alpha Security Protection

Uncategorized

Explore Over 43,000 TV Channels and Series with Atlas Pro’s 29€ Plan

Uncategorized

How Vintage Sportswear from the NBA, MLB, and NFL Can Elevate Your Fashion Game